Financial Synergy Meaning, Importance, and Types Financial, Teaching math strategies, Financial management

Contents:

Furthermore types of synergyes benefits arise from mergers also create financial synergy. One good example of financial synergy is the merger between Mitsubishi and the bank of Tokyo. Revenue synergy refers to the potential growth in sales in a merged company compared to the two companies individually. This type of synergy is preferred by both buyers and sellers because a higher revenue synergy gives the seller more bargaining power to increase the premium on their company’s cost. This means that horizontal mergers with good synergy could lead to better bargaining power for the seller because the buyer is willing to pay more to acquire his competition. A conglomerate merger is a merger between companies whose businesses and industries are entirely different from each other.

Increasing the market share and integrating key processes, such as manufacturing, may help to lower overall operating costs. It’s an excellent approach for smaller businesses to access markets in other nations that might not have been previously accessible. Such status allows it to take advantage of raising funds at lower cost. A vertical merger means a company either merge backward with a company that provides raw material or forward in the direction of the consumers. Another type is balanced integration this is a mix of the forward and backward merger.

The two companies are joined together through a cross-sharing agreement. The structure was unique in the auto industry during the 1990s consolidation trend and later served as a model for General Motors and PSA Peugeot Citroen. In general, the data counsel that mergers motivated by effectivity are more favored by the market than those that try and construct a company’s market power. Strategically speaking, buyers choose takeovers which might be likely to lead to value chopping to people who entail putting completely different companies collectively and trying to increase revenues. Dow-DuPont is an instance of a value-slicing deal, and one may fairly anticipate that, if completed, it is going to be shown to have created worth.

Reasons for the failure of M&A – Analyzed during the stages of M&A:

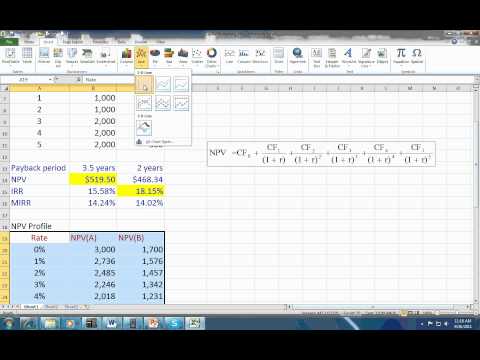

The buyer should pay out the premium to shareholders of merged company. The higher the premium, the lower the potential benefit for the buyer. It should be carefully forecast and discounted from net cash flows which are feasible within the chosen time frame.

Hearthstone: Best Festival of Legends Decks For Every Class – Den of Geek

Hearthstone: Best Festival of Legends Decks For Every Class.

Posted: Tue, 11 Apr 2023 07:00:00 GMT [source]

For example, when Kraft took over Cadbury, they tried to reduce prices by shutting down a factory that employed four hundred workers. This led to larger problems as Cadbury’s staff grew to become uncertain about their job security which resulted in Cadbury’s employees changing their perspective to work as a result of fears that arose. Investment synergy is the result of joint use of the plant, common raw materials inventories, transfer of R&D from one product to another, common tooling and machinery.

Failure can be caused by poor decision-making and second-guessing the other party. Acquisition of UberEats by Zomato, where one food delivery business acquired the other dealing exactly at the same level of the value chain. This acquisition although will take time to consolidate, it should in due course start showing results through overall growth depicted in Sun Pharma’s top-line and bottom-line reporting. Functional based JV is entered into by companies in order to achieve mutual benefit. When a company wants to grow or survive in a competitive environment, it needs to restructure itself and focus on its competitive advantage.

Creating New Products/Services

This classic example of Synergy planning is to identify business with similar or complimentary operations and joining hands with them. Firms planning to grow fast often consider either a Merger or an acquisition. A forward-looking, innovative approach to business and sustained team-effort to drive the business is called for. Business leaders and entrepreneurs must ensure democratic & participative processes that goes beyond a simple LLP registration and rather take partnerships forward with the workers. Besides the positive impact of revenue enhancements, cost reductions, and other efficiencies, valuation analysts need to price them in, too. Increased union between the French carmaker and its 43 percent-owned Japanese partner generated more than 4 billion euros in synergies in 2015.

Globally, businesses are caught up in an unexpected turn of events. The Pandemic has brought with it immense disruptions and unforeseen changes that has halt business growth. Inventories are piled up, manufacturing & supply chains disrupted and demand in a downward spiral, organizations and businesses are striving hard to respond decisively. Entrepreneurs and Founders are in hyper-mode to devise new strategies to ensure business continuity.

To subscribe to our weekly newsletter please log in/register on Taxmann.com

Properly planned, researched and executed, this approach to growth can help organizations to grow as envisioned. For organizations who have attained a secure position in their segment, found their market niche, and built a winning team, it is time to take a look at Synergy as a way forward. The business has is operating in efficiency mode, because the team, systems and processes that allow it to operate and make money are in place. Hence the leadership can focus on the next level of growth and business continuity – through Synergy – aimed at multiplying the business. For leaders, to achieve this objective, it is imperative to think beyond the organic growth of the business – they have to think on terms of multiplying the size of the business. This discount of staff members will end in decreased manpower prices, even after paying the severance packages to those who had been let go of.

They can be a completely new range, but makes the offerings more dynamic. As an example, LegalWiz.in started with the partners’ platform to offer Payoneer deals and other vouchers from corporates to muscle up small businesses. Operational synergies can be obtained by increasing operating profits. Operating profits could be achieved by linking the assets of companies in such a way that they could be used for multiple purposes. Operational synergy can also be achieved through achieving economies of scale arise from merger. Market synergies are similar to revenue synergies in that they both refer to an increased power to negotiate with customers on items.

Mergers and acquisitions (M&A) is a broad phrase that refers to one or more types of financial transactions that result in the consolidation of firms or assets. How do acquiring companies approach the M&A procedure when they are focusing on growth and enhancing their market position? This article sheds a light on various types of Mergers and Acquisitions with emblematic examples. It will help to form development strategies to mark their potential target in the market. One of the most well-known ways to grow business, either nationally or internationally, is through mergers and acquisitions (M&A). M&A is a phrase that refers to the combination of either businesses or assets adding complexity.

Fitch Rates Ryman Hospitality’s New Secured Facility ‘BB+(EXP)’/’RR1’ – Fitch Ratings

Fitch Rates Ryman Hospitality’s New Secured Facility ‘BB+(EXP)’/’RR1’.

Posted: Thu, 04 May 2023 17:50:00 GMT [source]

The various competition regulatory bodies have capped this form of synergy to some extent. Culture Clash – When two companies collaborate, many joint ventures fail due to a clash of cultures, processes, and approaches. Joint ventures can struggle to mesh due to disparities in management skills and abilities, conflicting HR processes, and workplace cultures. A large firm with good access to financing may contribute working capital to a joint venture with a firm that has limited financing capabilities but can provide key technology for product or service development. You are not unfamiliar with the term « marketing. » Marketing is the process of promoting a specific product.

They realized that their merger could result in reduced costs and an increase in profits. These two entities if merged would be termed as a ‘vertical merger’. Joint Venture is a separate entity formed by two or more companies to undertake commercial activities together. In a joint venture, a new enterprise is formed with participation in ownership, control and management of two or more parties. Competition is an important driver for change, and hence corporate restructuring becomes vital. Competition drives technological development, cost cutting and value addition.

Others generate a quick burst of activities and then slowly fade out. Others become permanent corporate fixtures without ever fulfilling their original goals. In short, the attempts are termed as ‘learning experience’ to coax the failures.

Synergy

Corporate restructuring is an action taken by the corporate entity to modify its capital structure or its operations significantly. Generally, corporate restructuring happens when a corporate entity is experiencing significant problems and is in financial jeopardy. A joint venture is formed when two or more businesses enter into a contractual agreement to collaborate on a specific project for a set period of time. Businesses collaborate and pool resources to ensure that the project is profitable for all parties involved. Lastly, A joint venture is a common business strategy used by companies that want to achieve a common goal or reach a specific consumer market. A franchise is typically a long-term agreement in which the franchisee pays an initial fee to the franchisor in exchange for the right to operate the business.

Competition is one of the most common and strong reasons for mergers and acquisitions. Every corporate restructuring exercise aims at eliminating disadvantages and to combine advantages. It plans to achieve synergy benefits through a well-planned restructuring strategy. Identifying allied products or services that offer more value when bundled with your existing product line is yet 1 more form of Synergy. To add heft to the existing product/service portfolio, companies can add a new product line or services which complement the existing product mix.

- The parties agree to contribute equity to form a new entity and shares the revenues, expenses and capital of the company.

- There is always synergy value created by the joining or merger of two companies.

- Capital, labor, assets, skills, experience, knowledge, or other resources useful to the single enterprise or project may be contributed by the parties.

- Similarly, when a joint venture fails, all participating companies bear a portion of the losses.

The reason for this merger was to increase operating efficiency, productivity and to gain by achieving economies of scale. ACC additionally invested around INR 20 – 25 crore for expanding the capacity at Damodar Cements after the completion of the merger. This lead to an increase in the cement capacity of ACC from 4.3 million tonnes to more than 5 million tonnes.

Searching for greater mental clarity? Maybe it’s time to start … – Stylist Magazine

Searching for greater mental clarity? Maybe it’s time to start ….

Posted: Fri, 05 May 2023 15:37:50 GMT [source]

Hence, there was considerable rise in number of suppliers and cut-throat competition. The strategy adopted shall depend on the purpose or organizational goals and hence a different strategy shall apply to different companies. Corporate Restructuring aims at different things at different times for different companies and the single common objective in every restructuring exercise is to eliminate the disadvantages and combine the advantages. Amongst the more commonly applied tactics in Synergy is starting a related or complimentary business.

Financial synergy could be in terms of a high return on equity, access to the larger and cheaper amount of capital etc. A combination of firms one with excess cash and the other with high return projects value addition will come from the projects that are taken from excess cash. Analysts expect their proposed merger to offer a competitive advantage over other multiplex operators, and drive bargaining power in terms of newer technologies, rentals and marketing spending.

If that’s the case, a combination of Equity and Cash could also be used to for the consideration of a Purchase Price to minimize the effect of dilution on EPS. Mergers end in human sources which might be tighter and more compact. A ship solely has one captain, and the mix of two firms implies that there will solely be one chief of the mixed company. A resulting organizational audit will reveal some positions or jobs to be redundant – a sure signal of inefficiencies – and streamlining the tasks and duties would mean job cuts.

In a franchise, the parent company grants a license to run a business using the parent company’s name, brand, and operating methods — examples include McDonald’s, Subway, UPS, and other low-cost franchises. Inequitable commitment – Ideally, a joint venture should be a win-win situation. An unbalanced joint venture can result from one of the partners’ lack of commitment. New market penetration – A joint venture may allow companies to enter a new market quickly because the local player handles all relevant regulations and logistics. Technical knowledge and expertise – Each business partner frequently brings specialized expertise and knowledge, which helps the joint venture be strong enough to move aggressively in a specific direction.